Younger drivers face precise demanding situations on the subject of finding the proper Car insurance in 2023. How can they at ease the high-quality prices with out compromising on insurance?

When you’re a teen or a younger person, shopping for Car insurance is rarely a laugh or low-priced. This is actual for each person seeking to add insurance to a figure’s present policy, but it’s even greater actual for teens who want to find cheap Discounts insurance on their very own.

We in comparison more than 20 of the quality Car insurance groups to help you discover the satisfactory car insurance for younger drivers in 2024. In case you’re geared up to buy a policy or start comparing all your alternatives, you could stop searching and begin your seek here.

That stated, the excellent car insurance for young drivers offers nice safety for the complete household without breaking the bank. In case you’re looking for the quality reasonably-priced car insurance for young adults, however, you’ll need to examine policies and plans even as also checking for discounts you might qualify for.

Inside the meantime, you’ll want to peer which varieties of car insurance you really want and which of them you could cross without.

Our choices for high-quality Car Insurance for younger drivers

- Nationwide: Best for Teen Drivers

- American Family: Best for Usage-Based Discounts

- Allstate: Best for Good Students

- State Farm: Best for Safe Vehicle Discounts

- Geico: Best Discounts Overall

- USAA: Best for Military

1. Nice for youngster drivers: Nationwide

Nationwide offers an array of insurance options for teens and younger drivers, as well as discounts that may make insurance notably greater inexpensive. Younger drivers can purchase insurance with legal responsibility-only insurance , however they can also opt for collision insurance, comprehensive insurance , and even condominium Discounts reimbursement insurance that kicks in when a car is in the shop getting upkeep after an coincidence occurs.

Coincidence forgiveness is some other optional feature for younger drivers. This upload-on insurance ensures that a teenager or young driving force’s car insurance charges won’t surge right away after their first at-fault car twist of fate occurs.

Main discounts available from Nationwide for teenagers and young drivers encompass:

Good Student Discount: If you’re a full-time student and a nationwide customer, you can get a discount in your rates in case you preserve a grade point average of ‘b’ or higher.

Employer-Sponsored Plan Discount: If you work for an agency who participates in a national discount plan, you could get a damage there.

Multi-policy Discount: You may also get a reduction by way of bundling your Car insurance with different rules, such as renter’s insurance .

SmartRide Discount: Nationwide also offers a discount if you meet secure driver standards as determined by means of Discountsa plug-in tool. It’s a utilization-based totally insurance software that enables you to earn a discount for safe driving.

2. Best for Usage-Based Discounts: American Family

American family insurance is another especially-rated insurance employer that extends insurance to younger drivers and teenagers who’re being brought to a own family plan. This company offers all of the simple insurance insurance you will assume, from legal responsibility insurance to collision, complete insurance, uninsured and underinsured motorist insurance , and apartment Car compensation. In addition they provide non-compulsory emergency roadside insurance, which may be accessed comfortably the usage of the myamfam cell app.

This employer also offers a safe driver Discounts software for teens, which video display units your teen’s Discountsconduct with the assist of a cellular app. As soon as a youngster drives at the least 3,000 miles with the app on, families can qualify for a 10% Discounts on their car insurance premiums.

Different exceptional Discounts for younger drivers include:

Away at School Discount: this Discounts can practice when a young motive force is away at university or college and their Discounts stays parked at domestic.

Good Student Discount: college students with right grades can pay less for Discounts insurance rates general.

Multi-Product Discount: pay much less for Discounts insurance rates when you package deal more than one guidelines with american family.

Younger volunteer discount: this Discounts can follow while a motive force under the age of 25 completes forty hours of volunteer paintings in step with yr for a non-income.

3.Best for Good Students: Allstate

Allstate is another insurer that is recognized for its accident forgiveness software. Whilst becoming a member of this program doesn’t help you decrease your top class at the beginning, you won’t see your month-to-month Car insurance charges surge after your first twist of fate. Inside the intervening time, allstate additionally has a safe driving bonus software. If you add this selection for your insurance , you get a take a look at inside the mail each six months in case you don’t have an accident. That is allstate’s way of incentivizing safe Discounts conduct.

Additionally, word that allstate extends precise student Discounts for drivers who are under the age of 25. This indicates excessive faculty college students and young adults with properly grades can help their dad and mom cozy decrease Discounts insurance costs, however it additionally manner teenagers in university can get a reduction on their own policies.

Allstate’s exceptional Car insurance Discounts for younger drivers encompass the subsequent:

Allstate drivewise Discount : young drivers who install a tool on their Discounts and allow allstate display their driving conduct will pay less for Car insurance usual.

Multi-Policy Discount : a multi-policy Discounts can follow while younger drivers buy a couple of policies from allstate, which includes Car insurance bundled with a renter’s insurance policy.

Accountable Payer Discount : if you pay your charges on time for an entire year, you could get a accountable payer discount the subsequent year you buy insurance .

Smart Student Discount : applies to drivers under the age of 25 who meet one of three alternatives, which include getting appropriate grades or completing a youngster driving force education software.

4. Best for Safe Vehicle Discounts: State Farm

State Farm gives a application for young drivers below the age of 25, that is referred to as steer clear. This software requires drivers to use a cellular app that monitors their using, and it’s far most effective to be had to younger drivers who don’t have any at-fault injuries or shifting violations in the ultimate 3 years. Folks who qualify for this program can keep up to twenty% off their Discounts insurance rates once they keep away from accidents and drive appropriately over the longer term.

Now not most effective does country farm make it smooth to feature a younger driving force to a household Discounts insurance policy, however they also offer less expensive rates for young drivers who’re out on their very own. Additionally, this company offers an array of discounts that relate to Discounts safety rather than the age of the driver, together with passive restraint Discounts and discounts for having an eligible anti-theft tool mounted on a Car.

Other discounts for young drivers offered by State Farm include:

Drive Secure & Save Discount : This program makes use of facts out of your smartphone or your Car’s onstar or sync verbal exchange provider to calculate your discount.

Protecting Driving Course Discount: young drivers who whole a protective driving direction can get hold of 10% to 15% off their annual Car insurance premiums.

Student Away at School Discount: if you are a student under the age of 25 and you are living away from domestic while enrolled in college, you would possibly qualify for this discount.

Talented Student Discount: this discount can reduce your Discounts insurance rates with the aid of as an awful lot as 25%, but you do need to publish appropriate grades to qualify.

5. Excellent Discount Overall: Geico

Geico is one of the maximum fee-aggressive Discounts insurers available on the market, and it offers pretty a few discounts and applications for younger drivers. For starters, this issuer offers a family pricing software that shall we younger drivers get the identical insurance charges as skilled drivers in the same own family. This means younger drivers get the risk to set up an amazing Discounts record without paying excessive charges which are common for brand spanking new drivers.

Geico also offers an coincidence forgiveness application for drivers of every age. This Discounts applies to most effective one member of the family on a unmarried policy, however it enables prevent surging charges within the event of an at-fault twist of fate.

Other Popular Discounts From Geico encompass the following:

Good Driver Program: Younger drivers can keep as much as 22% off car insurance rates with the 5-year accident-loose accurate motive force Discount .

Government Employee Discount: This Discount is legitimate with collaborating employers, but it’s additionally available to federal personnel. It can reduce your top class by as much as 12%.

Military Discount: Save up to 15% off your rates if you’re a member of the army.

Good Student Discount: this Discounts is to be had to drivers between the a while of sixteen and 24 who’re complete-time college students with a “b” average or higher.

6. Best for Military: USAA

If you’re a member of the military or an eligible member of the family, you may also qualify for Car insurance through usaa. This agency is one of the maximum-rated insurance corporations across the board, and they offer an array of applications and Discounts for younger drivers and teen drivers alike.

For instance, usaa gives a software referred to as safepilot which could assist all and sundry keep up to 30% off their car insurance charges if they complete a safe driving program and live in an eligible country. Families who’ve a teenager on their policy can also help their children save after they leave the following. In reality, person kids of usaa car insurance clients qualify for a ten% circle of relatives Discounts.

Other USAA Discounts for young drivers are listed underneath:

Driver Training Discount: it’s viable to store on car insurance rates if you are below the age of 21 and willing to complete a motive force schooling or protecting Discounts direction.

Safe Driving Discounts: you can reduce your premiums through maintaining a good Driving report for at the least 5 years.

Talented Student Discounts: young drivers get a discount with appropriate grades at school, and students from ages 16 to twenty-five can be eligible.

Family Discounts: pay less for Car insurance when you add a teenager or young adult to an existing circle of relatives’ insurance.

Car Insurance Guide

Before you settle on a brand new car insurance, you should recognize the ins and outs of Car insurance for younger drivers. As an example, you’ll want to analyze the distinct sorts of car insurance, in addition to the common price of Car insurance primarily based on the policy you buy, where you live, and different elements.

How does Car insurance for more Younger Drivers Work?

Vehicle insurance for younger drivers works the same as insurance for all people else, yet this kind of insurance safety tends to be extra costly standard. The fact is, younger drivers have notably less enjoy on the road, and they continuously have accidents at a far better charge as a end result. Consistent with the cdc on average 18 teenagers die every day in fatal car crashes. The insurance institute for motorway protection reviews that teenagers aged 16-19 are 3x much more likely to get in a crash in comparison to the ones two decades or older.

To account for this elevated stage of hazard, Car insurance groups rate higher premiums for the identical forms of insurance.

Usually speaking, but, Discount insurance costs generally tend to go down as soon as individuals flip at the least 25 with a safe driving report. Getting married also can help decrease car insurance premiums notably, as can becoming an owner of a house, having a very good credit rating, and achieving different crucial lifestyle milestones.

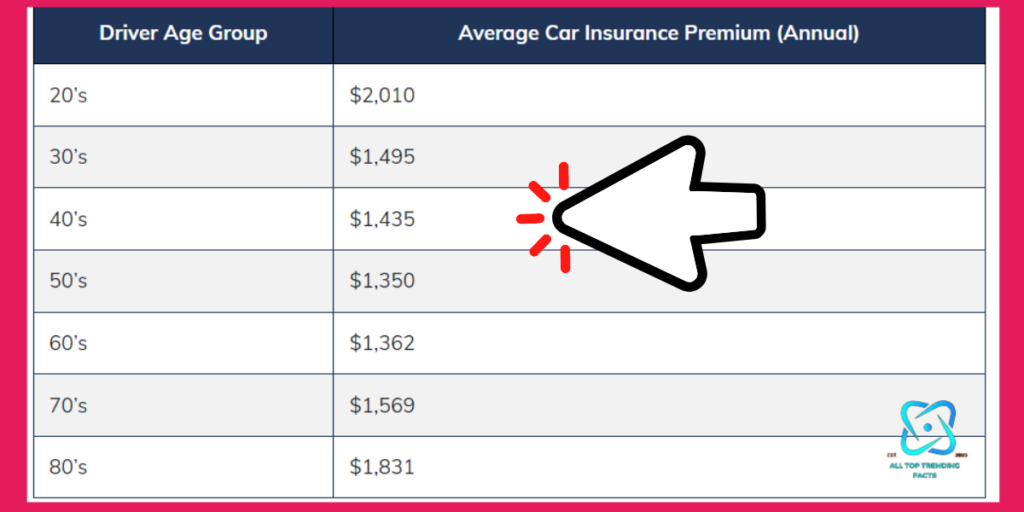

As we stated already, the average top class for younger drivers varies depending on wherein you stay, whether or not you stay on a determine’s policy and other factors. But, a latest document from the zebra suggests that a few age agencies generally tend to pay a whole lot better premiums universal, including some precise age groups below 25.

Consistent with 2023 figures released within the examine, drivers in the “teenager” age institution pay the maximum, with a regular sixteen-12 months-vintage motive force paying a mean of $6,034 in keeping with year for their own car insurance policy. In the meantime, the common annual price for all teenagers works out to $four,796 annually.

From there, every age group gets a better deal on Discounts insurance rates until drivers reach their 60s and prices start to tick up. The chart below shows the average car insurance premium by age group in 2023:

How to lower Car insurance Expenses

Whether you decide to lease or buy a car or you’re presently driving a vintage beater whilst you look ahead to the best time to shop for a brand new Car, there are masses of steps you can take to attain extra low-cost Car insurance premiums. A number of the best techniques you may use to store money are distinctive underneath:

Keep away from Accidents and moving violations: Stepping into an accident or getting a price tag (or numerous) can motive your Discounts insurance fees to surge better than they already are. To get the cheapest car insurance feasible, you’ll want to keep a secure driving document for the long haul.

Be willing to take driving publications: You may be able to save money on car insurance in case you whole a teen driver training course or a protective driving course. Make sure to test along with your Discounts insurance business enterprise to peer which of those options let you rating a discount.

Check for all Potential Discounts: You may qualify for car insurance Discounts you don’t even understand approximately, however you’ll in no way understand except you test. See whether your insurance business enterprise gives car protection discounts, bundled policy discounts, loyalty Discounts, or different Discounts that can help you shop for money.

Get top grades: In case you’re a university scholar and you could maintain an excellent grade factor common, probabilities are excellent you can rating a reduction for your Car insurance charges. For the most elements, suitable grade discounts go to those who can hold a gpa of 3.Zero or higher (or equal).

Stay on your parent’s car insurance plan as much as possible: Typically speakme, car insurance charges for young adults are decrease after they’re brought to an current insurance . With that during mind, it can assist to cast off shopping for your personal Discounts insurance policy for so long as you can.

These are simply some of the Discounts insurance discounts for college kids, however there is probably others relying on the organization you pick out for insurance . While you shop round to your Car insurance insurance , make sure to ask which discounts you might be eligible for.

How We Found the Best Car Insurance for Younger Drivers

To find the first-rate Discounts insurance agencies on the market these days, we searched for companies who have an ‘a’ score or higher for economic power from a.M. High-quality.

We also looked for agencies that offer rather-rated cellular apps, in addition to people who advertise special programs and discounts for teen drivers.

Subsequently, we have best taken into consideration Car insurance organizations which have an ‘a’ rating or better with the higher commercial enterprise bureau (bbb).

Summary of the Best Car Insurance for Younger Drivers January 2024

- Nationwide: Best for Teen Drivers

- American Family: Best for Usage-Based Discounts

- Allstate: Best for Good Students

- State Farm: Best for Safe Vehicle Discounts

- Geico: Best Discounts Overall

- USAA: Best for Military

“Hello Everyone” Myself Joydip DN, and I Live in Sylhet And I am a Seasoned Digital Marketer, Accomplished Content Writer, Experienced Blogger And Combines A Wealth of Experience In Online Marketing Trained From Freelancer Lab Academy, With A Strong Linguistic Proficiency, Evident In My Impressive IELTS Band Score. Holding An, MBA With A Major In Management Information System(MIS) From Leading University. I Am(Joydip) Seamlessly Integrates Strategic Business Insights With Technological Acumen To Deliver Organic And Impactful And Results-Driven Content In The Dynamic Digital Landscape. Contact with me: debnathjoydip4@gmail.com”

2 thoughts on “Best Car Insurance for Young Drivers in 2024”